Help Center

Routing Number

067015779SWIFT Code

BBUBUS33XXXZelle®

Zelle® Send Limits by account$15,000 per month

Business accounts:

$5,000 per day

$25,000 per month

Contact Us

Get assistance from our Client Care Center specialists:- U.S. Toll-Free: 888-228-1597

- From Venezuela: 0-800-1-228226

- From the U.S. or other locations: 786-552-0524

Email us at:

customerservice@banescousa.com

FAQs

What is my routing number/ABA?

The Banesco USA routing number is 067015779.

What is the Banesco USA SWIFT Number?

The Banesco USA SWIFT Number is BBUBUS33XXX.

How do I find my account number?

Find your account number by signing into Online Banking or the Mobile app, choose your account > Details & Settings.

You can also find your account number on a paper check by looking at the last 12 digits printed at the bottom of the check.

How do I reorder checks?

Reorder checks by signing into Online Banking or the Mobile app, choose Services > Check Reorder. Or, contact a Client Care Specialist Monday to Friday from 8:00 a.m. to 6:00 p.m. ET. Within the USA: 1-888-228-1597 From Venezuela: 0-800-122-8226 customerservice@banescousa.com What are account maintenance fees? Account maintenance fee is charged for utilizing your account if certain requirements aren’t met. All fees and costs can be found in the “Fees” section at the bottom of our webpage.

FAQs

What happens when my CD matures?

How much interest will I earn on my CD?

Can I add money to my CD?

- For term <30 days, penalty is 7 days of interest.

- For term >31 days to <or= 355 days, penalty is 90 days of interest.

- For term >366 days to <or= 541 days, penalty is 180 days of interest.

- For term >542 days to <720 days, penalty is 270 days of interest.

- For term >721 days to >1094 days, penalty is 365 days of interest.

- For term >1095 days, penalty is 540 days of interest

FAQs

How is a debit card different from a credit card?

Why should I use a debit card for my purchases?

- Purchases are automatically deducted from your account so you won’t receive an unexpected bill

- Use the card to transfer funds between your Banesco USA accounts to cover expenses

- Get cash when traveling at thousands of ATMs around the world

Is there a limit on how much I can withdraw at an ATM?

Is there a purchase amount limit on my debit card?

Where can I use my debit card?

Can I use my debit card on Apple Pay and Google Pay?

How do I upload my personal debit card to digital wallet?

What is Card Controls?

How do I know if my account information is secure when paying for online purchases with my debit card?

Am I responsible for purchases if my debit card is lost or stolen?

FAQs

What is Zelle®?

Who can I send money to with Zelle®?

How do I get started?

What are my Zelle® send limits?

How can I learn more about Zelle®?

- U.S. checking or savings account required to use Zelle®. Transactions between enrolled consumers typically occur in minutes and generally do not incur transaction fees.

- Transaction typically occur in minutes when the recipient’s email address or U.S. mobile number is already enrolled with Zelle®.

FAQs

How do I enroll in Online Banking?

What will I need to enroll in Online Banking?

What type of bank account do I need to use Online Banking?

What should I do if I forget my Online Banking password?

How can I change the language in my Online Banking profile?

What is a digital token?

Do I have to use a VIP Access digital token?

Is there a charge to use Online Banking?

What banking transactions can I do with Online Banking?

Can I add an authorized user to my business Online Banking Profile?

How do I change from physical bank statements to paperless bank statements?

FAQs

How do I get started with Mobile Banking?

What will I need to enroll in Mobile Banking?

Is there a charge to use Mobile Banking?

Is Mobile Banking secure?

FAQs

How does mobile check deposit work?

When can I access funds made with mobile deposit?

- Cashier’s, certified, teller or government checks, checks on a Banesco USA account and the first $225 of a day’s deposits of other checks: Funds are available the first business day after the day of deposit

- All other checks: Funds are available the second business day after the day of deposit.

FAQs

What bills can I pay online?

Can I schedule payments in advance?

Can I set up bills to be paid every month?

Is there a fee to use Online Bill Pay?

FAQs

How can I register to send a wire transfer in Online Banking or the Mobile app?

How do I send a wire transfer?

How do I request banker assistance to send a wire transfer?

How do I receive an incoming wire transfer?

- Your full name or company name and address linked to your Banesco USA account

- Your Banesco USA account number

- The ABA routing number or SWIFT Code

- The Banesco USA address: 3155 NW 77th Ave., Miami, FL 33122

- The Banesco USA Tax ID: 202768796

What do I do if the sender of an incoming wire requests a certification letter?

FAQs

What is FDIC Insurance?

What amount of FDIC coverage I can receive?

FAQs

What is BanescoVoice?

What can I do with BanescoVoice?

How do I use BanescoVoice?

FAQs

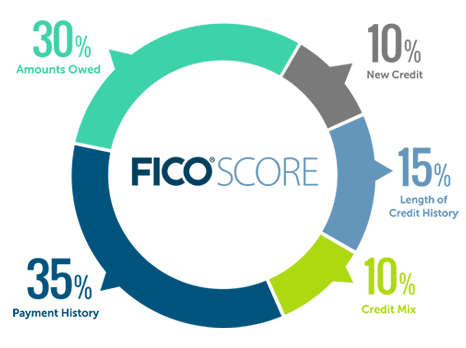

What are FICO® Scores?

Why are you providing FICO® Scores?

What goes into FICO® Scores?

- 35% – Payment history: Whether you’ve paid past credit accounts on time

- 30% – Amounts owed: The amount of credit and loans you are using

- 15% – Length of credit history: How long you’ve had credit

- 10% – New credit: Frequency of credit inquiries and new account openings

What are score factors?

Why is my FICO® Score different from other scores I’ve seen?

Why do FICO® Scores fluctuate/change?

Will receiving my FICO® Score impact my credit?

How do I check my credit report for free?

How often will I receive my FICO® Score?

Why is my FICO® Score not available?

Additional FICO® Score Information

FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries. Banesco USA and Fair Isaac are not credit repair organizations as defined under federal or state law, including the Credit Repair Organizations Act. Banesco USA and Fair Isaac do not provide “credit repair” services or advice or assistance regarding “rebuilding” or “improving” your credit record, credit history or credit rating.

Online and Mobile Banking How To Videos

Get Started

- Enroll

- Login

- View account activity

- View account details and history

Personal – Make Transfers & Payments

- Transfer funds between accounts

- Send domestic and international wires

- Make a tax payment

- Register for Zelle®

- Bill Payment

Business Transfers & Payments

- Positive Pay

- Same Day ACH

- Split Transactions

- ACH Positive Pay

- Register for Zelle® for Small Business

- ACH Payment Creation

- ACH File Import

- Commercial Reports

Manage Accounts

- Add authorized users

- Recipient Management

- Add external accounts

- Enroll to receive eStatements

- Send a secure message

- Set up alerts

Manage Debit Card

- Change PIN

Enroll in Online Banking

Enroll in Online Banking